Operational Excellence - I

For Garanti BBVA, financial performance is at the core of value creation process and is both the cause and effect in delivering sustainable growth. The Bank has a direct and indirect impact on the economy, by making its products available to customers, investing in its facilities and constantly improving its business model and processes with an operational and environmental efficiency point of view.

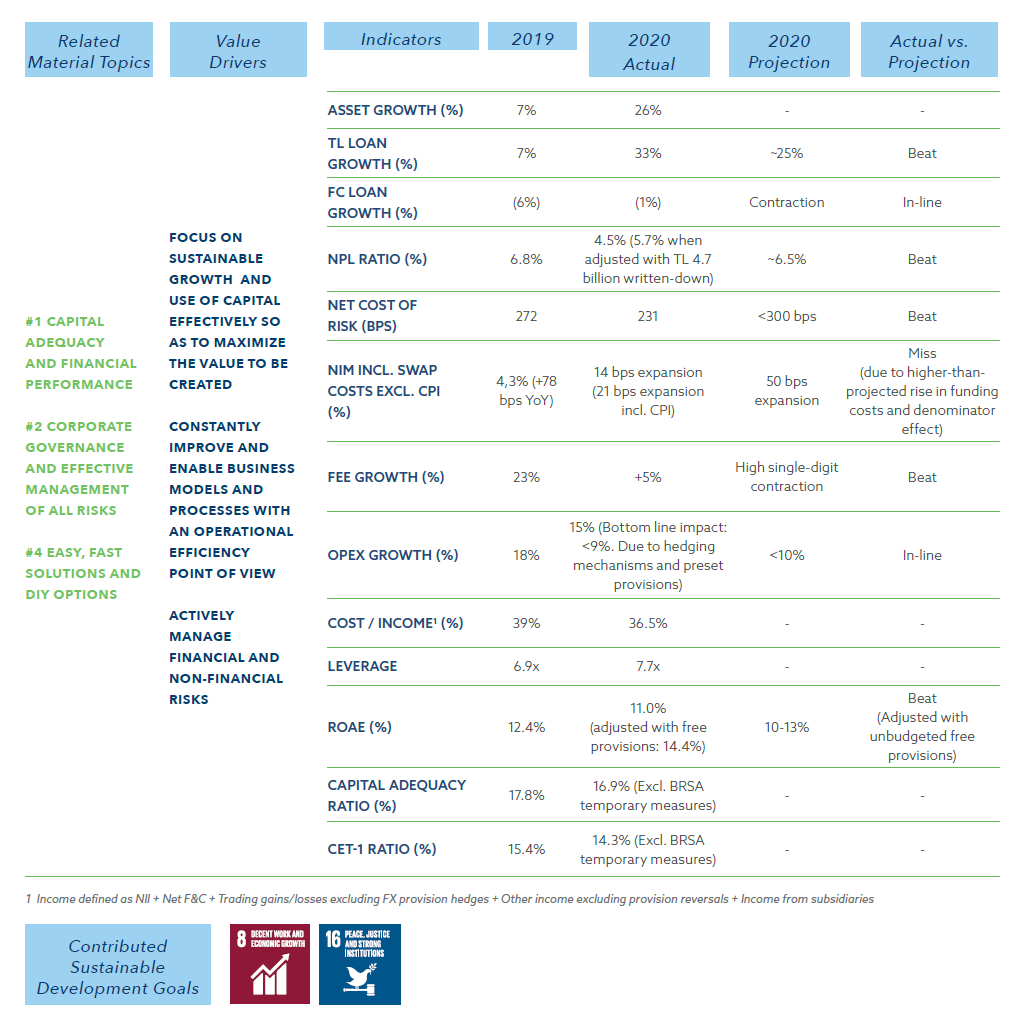

Aiming to use capital effectively to maximize the value created, Garanti BBVA focuses on disciplined and sustainable growth on the basis of a true banking principle with strict adherence to solid asset quality and prudent stance. Combining this approach to unconditional customer satisfaction with its robust capitalization and a focus on efficiency, Garanti BBVA sustains its contribution to the economy through effective balance sheet management.

In 2020,Garanti BBVA increased its consolidated total assets by 26% on an annual basis, bringing it to TL 541 billion, attained 29% growth in total performing loans and increased the percentage of interest-earning assets to total assets from 82% to 84% . Standing by its customers at all times, Garanti BBVA brought the share of loans within total assets from 60% to 62%. Today, Garanti BBVA pioneers the sector across various segments from retail banking to payment systems, mortgages to auto loans, SMEs to project finance, transaction banking to digital banking.

Garanti BBVA preserved its liquid balance sheet composition with the help of its prosperous dual currency balance sheet management in 2020 that was characterized by high volatility induced by the pandemic. Diversified and dynamic funding base of the Bank continued to be largely composed of customerdriven deposits. Growth rate in customer deposits base was 30%, parallel to the expansion in lending, which helped Garanti BBVA keep its loan to deposit ratio (LDR) at 94% on a consolidated basis. Garanti BBVA’s strength in consumer deposits is the outcome of its innovative business model, which places customers’ needs and satisfaction at the core of its business.

Lending rates relatively decreased as a result of the financial support packages made available to the sector because of the pandemic. The plunged currency followed by expansionary policies, in conjunction with stronger domestic demand triggered inflation. The CBRT began implementing tight monetary policy due to inflationist pressures, resulting in higher funding costs in the second half of the year. In spite of the growing pressure of funding costs and declined lending rates, Garanti BBVA succeeded in expanding its Net Interest Margin (NIM) as compared to yearend 2019 thanks to its diversified funding structure, increased share of demand deposits in total deposits, and income on CPIlinkers. Garanti BBVA was able to increase its NIM including swap costs by 21 basis points on a year-over-year basis, and with 5.4%, continued to have the highest NIM level among its peers.

Garanti BBVA follows a prudent and risk-return focused lending strategy. The Bank displays a proactive and consistent approach to risk assessment that ensures preservation of its solid asset quality. In the reporting period, provisions remained high for maintaining the prudent stance due to negative effects stemming from the pandemic, decelerated economic activity and increased unemployment. Net cost of risk, excluding currency impact, was 2.3% in 2020. Since the Bank maintains on-balance sheet FX long positions against currency impact on provisions, increased provisions resulting from devaluated currency does not have an effect upon bottom line profit. Payment deferral was introduced in an effort to support the sector players against the pandemic-related challenges in 2020, and the time allowed for loans to remain unpaid before they are classified as NPL was doubled to 180 days from 90 days. Therefore, net new Non-Performing Loans (NPL) remained on the negative side. Due to this arrangement, the NPL ratio went down from 6.8% in 2019 to 4.5% in 2020 with the effect of the strong growth in lending and loans written down.

Garanti BBVA’s diversified and actively managed funding base, its capital adequacy ratio of 16.9% excluding BRSA’s temporary measures, its growing deposits with approximately 19 million customers’ trust, and continuous access to foreign funding sources bolster the Bank’s business model and long-term sustainable growth.

Its business model, along with its well-diversified fee sources and its further digitalized processes, support the Bank’s ability to generate sustainable income. All of them combined secure the highest net interest margin, and the highest net fees and commissions base among its peers. Furthermore, Garanti BBVA maintains its focus on efficiency and effectively manages its operating costs to foster sustainable value creation.