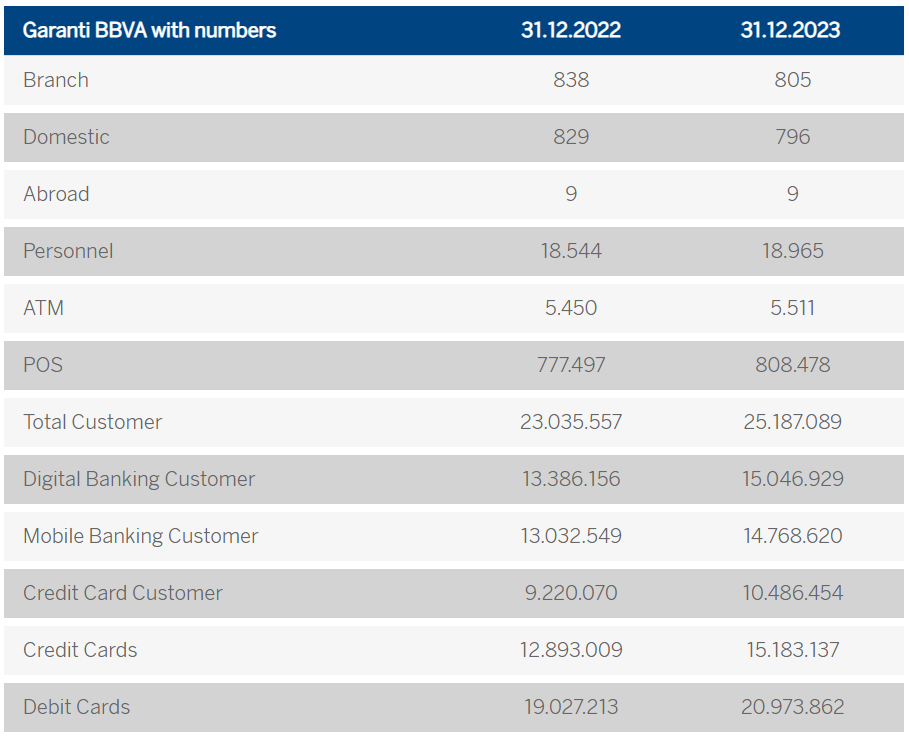

Garanti BBVA In Numbers

As of 30 June 2025, Garanti BBVA provides a wide range of financial services to its over 28 million customers with total 22,985 employees including subsidiaries through an extensive distribution network of 790 domestic branches, 7 foreign branches, 6 in Cyprus and one in Malta, and 1 international representative office. Garanti BBVA offers an omnichannel convenience with seamless experience across all channels 6.026 ATMs, an award winning Call Center, internet, mobile and social banking platforms, all built on cutting-edge technological infrastructure.